The other day, one of my students asked me about the contra accounts. I was quite surprised – this topic doesn’t come up often.

Honestly, it got me thinking: is it because they are perceived as too complex, or do people assume they won’t encounter them in real life?

Regardless, it’s time to clear the mist.

Will you use them?

You most probably will use contra accounts in your day-to-day bookkeeping (even if you don’t realize it )

Why should you use it?

They’re incredibly handy for keeping financial records clean and also providing additional information for management and decision-makers

What’s the jist?

The single key to understanding contra accounts is to remember that Contra means “opposite”.

So whenever you hear the words “contra accounts”, the first thing you associate is “opposite”.

Remember this, and you’ll have no trouble answering questions like: “Is a contra asset a debit account?” (Hint: No, it’s not – details below 😉)

What is a Contra Account?

A contra account offsets the normal balance of the account it is associated with.

Well, this might sound a bit more technical than it should.

Let’s break it down:

1) There is always an associated (main) account: either an asset, a liability, an equity, a revenue, or (rarely) an expense account.

2) The contra account’s purpose is to reduce/offset the value of the main account without mixing the two together

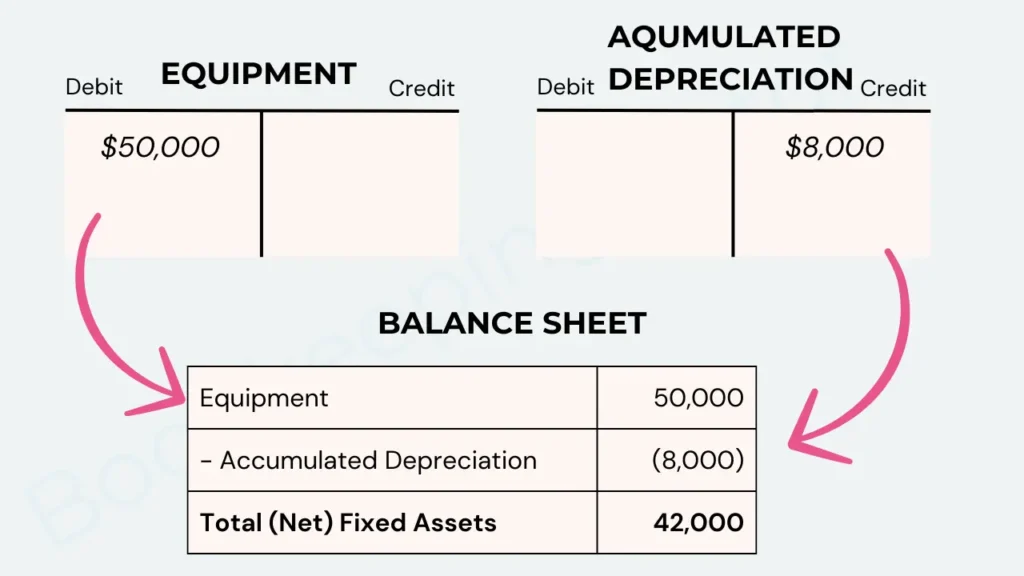

For example, a common contra asset account is Accumulated Depreciation. It offsets the fixed asset account (like Equipment) to show the net book value of the asset.

Let me show you how it works:

Types of Contra Accounts

Based on the associated main account, the contra accounts can be:

- contra asset account

- contra liability account

- contra equity account

- contra revenue account

- contra expense account

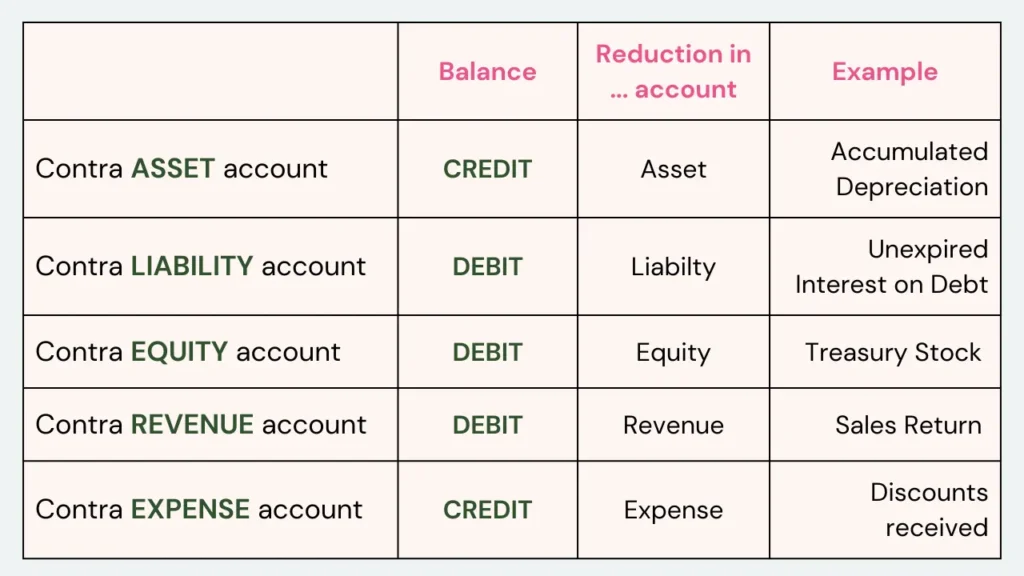

Because the contra account offsets the associated account’s balance, the balance of the contra account is exactly the opposite of the main account.

So, a contra asset account has a credit balance because the normal asset typically has a debit balance. A contra revenue account’s typical balance is debit because the normal revenue account has a credit balance.

Easy, isn’t it? But generally, this causes the most confusion … whilst it shouldn’t have. Remember: just the opposite 😉

Here’s a little cheat sheet:

Why Use Contra Accounts?

Using contra accounts allows you to report the original amount, the reduction and the net amount separately in the financials.

Why is it important?

Firstly, it provides clarity. Secondly, it facilitates better analysis. Keeping them separate provides additional and more detailed information to the management.

For example, the sales returns figures can be crucial information for the sales and production teams that wouldn’t be known from the accounts if they were recorded on the normal Sales account.

Key takeaway

Pretty simple: if you take away one piece of information from this post, it should be this:

CONTRA = OPPOSITE

I believe in You: you’re a champion 🏆