If you’re learning bookkeeping, you might have heard that you need to post the journal entry to the ledger and then you need to create your trial balance from your general ledger.

You might have wondered what exactly the ledger and the general ledger are and what the major difference between them is, if any.

The ledger

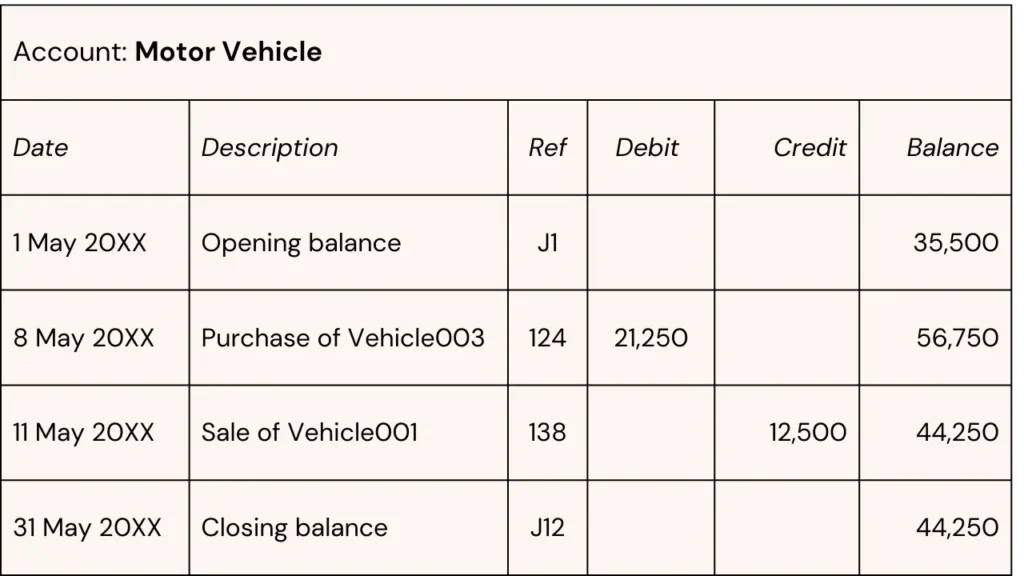

According to bookkeeping theory, the ledger is a book in which accounting transactions are recorded for each account. The ledger includes detailed information about all transactions that occurred during the period.

The business maintains ledgers for all accounts, and there may even be separate ledgers for specific subdivisions of the transactions (such as receivables from XYZ customer).

The ledger shows

- the opening or brought-forward balance,

- the list of the transactions, and

- the closing or carry-forward balance.

A ledger can be seen as a page in your financial books that records the information on all transactions in chronological order that can be allocated to that specific type of transaction.

Each ledger is associated with one account in your chart of accounts.

One advantage of the ledgers is that the running balance of that account is known at any point in time.

The general ledger

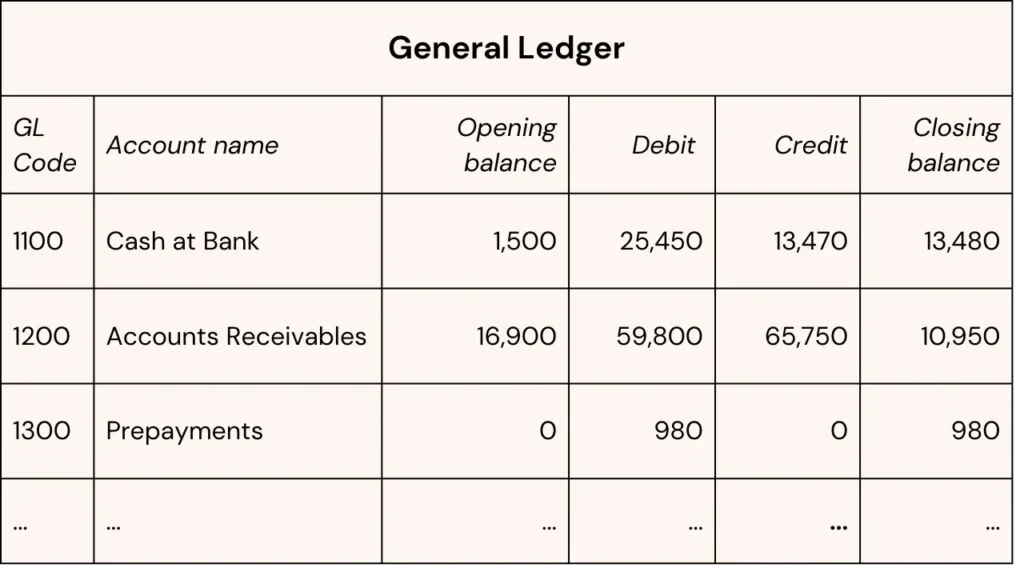

The general ledger is the complete record of the business’ transactions that occurred over a period of time. It contains the summarised information of all accounts and serves as the basis for preparing the financial statements.

In the general ledger, you will find all accounts, their opening balances, the total debits and credits and their closing balances.

The advantage of the general ledger is that it aggregates all financial information. Therefore, it helps prepare the financials and easily analyze the data.

The difference between the ledger and the general ledger

There are two major differences between the ledger and the general ledger.

1) A business will have multiple ledgers and only one general ledger.

This is because a ledger is practically associated with an account, so any company will have as many ledgers as accounts, whilst the general ledger consolidates the information of all the accounts into one central record.

2) The ledger contains detailed information on the transactions, while the general ledger summarizes the information available.

As demonstrated above, the ledger contains transactional information, while the general ledger contains account-level information.

Do we still use the ledgers and the general ledger in bookkeeping?

The answer is a straightforward yes: each and every accounting software uses ledgers and the general ledger.

However, you as a user may not even recognise this – and that’s the reason why it’s super challenging to understand the significance of learning about these concepts in your bookkeeping studies.

Honestly, you can effectively manage your daily bookkeeping tasks without knowing about the ledgers 🫣.

In the old days, when bookkeeping was done manually, it was indeed crucial to know how to transfer a journal to a ledger, how to consolidate the ledgers into a general ledger, then how to create a trial balance from the general ledger and so on.

Nowadays, you record the business transactions in your accounting software and all the rest is managed by the software at the backend. So, seconds after you enter the transaction, you can run a balance sheet or an income statement. It would contain the imprints of that particular transaction without manually transferring journals to ledgers and so on.

Most accounting software has a General Ledger report that you can run at any time. If you want to look at a ledger, you should run an Account Transaction report or a detailed General Ledger report (depending on your software). So, the ledger and the general ledger are there in the software as special reports or “views”, but you, as a user, don’t need to record anything directly into the ledger and the general ledger. Once you enter the business transaction, the software processes the rest.

Key takeaways

On a ledger, you’ll find the details of the transactions in chronological order.

The general ledger compiles all accounts and sums up the transactions for each account.

They played crucial roles in the manual bookkeeping systems. In computerized accounting systems, although they are still used in the background, they’re “views” or special reports you can run at any time.

I believe in You: you’re a champion 🏆